Home > Sustainability > ESG Strategy

ESG refers to set of criteria used by organisations to evaluate a company’s performance and impacts in three key areas of Environment, Social & Governance

Incorporating environmental, social and governance factors into company’s operations, management practices and decision-making processes:

“Mining Risks and Opportunities Study’ has revealed that, although environmental, social and corporate governance (ESG) factors pose the biggest risk for miners, it also represents their biggest opportunity to drive differentiation and improvements that will create long-term value for all stakeholders” Quintin Hobbs

Debswana is committed to advancing industry standards, enhancing the transparency of business processes and improving livelihoods of communities within which we operate and the entire nation of Botswana: through integrating consideration of ESG into its business processes.

Our Priorities for ESG Integration

Our Approach to achieving ESG Commitments:

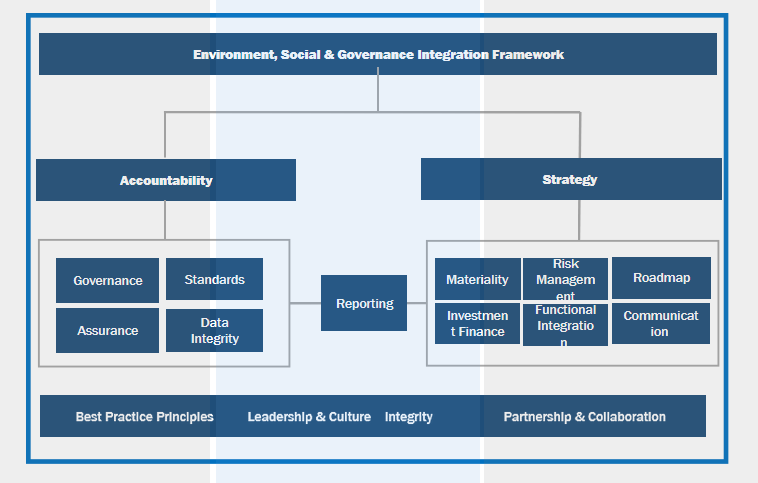

The ESG Integration Framework is designed to navigate the intricate landscape of ESG

The success of the integration is underpinned by the foundations of:

Board and Executive accountability and oversight of our ESG portfolio is through our Board and Corporate Sustainability Committees.

We have processes for broad scanning identifying best practice standards and further ensure compliance across our business.

We are establishing robust processes for collecting, collating, approvals and analysis of our ESG data.

Our assuarance process include four levels of defense. Providing confidence to our stakeholders on the integrity of our work.

Significance of environmental, social & governance factors to company’s business operations, performance & stakeholders

Identifying, assessing, mitigating & monitoring risks related to ESG

Creating a strategic plan to integrate ESG considerations into company’s business operations, governance practices & stakeholder engagements

Incorporation of ESG considerations into various functional areas within the organization

Practice of incorporating ESG criteria into investment decisions & strategies

Transparently sharing information about a company’s ESG performance, initiatives & impacts to stakeholders

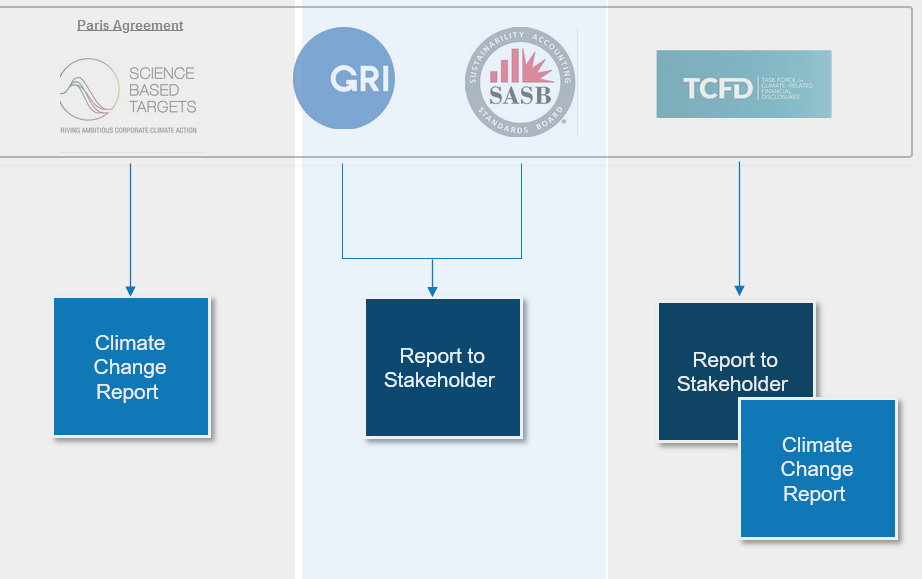

Our delivery Framework: Reporting

Want to read to our news letters, follow the button below.

Powered by Debswana © 2024